The market for Customer Relationship Management Software continues its growth also in 2015.

According to Gartner’s latest analysis, CRM software market has increased by 12,3% compared to 2014. In 2014 CRM software owned a share of $23,4 billion. By listening to the market and adjusting to demand the share grew to $26,3 billion in 2015. There seems to be no stopping to CRM revolution as companies keep developing their systems. Researchers predict that CRM software will reach a share of $36,5 billion by 2017.

This is a clear indication that this is the area to be for tech companies that wish to increase their market and customer shares significantly.

Enterprise Apps Today call CRM the hottest areas in enterprise applications today, so it makes sense that everyone wants a piece of this pie. Different researches have different opinions on the top vendors and their market shares, but they agree that the top 4 software providers are Salesforce, Microsoft, SAP and Oracle ( not necessarily in that order).

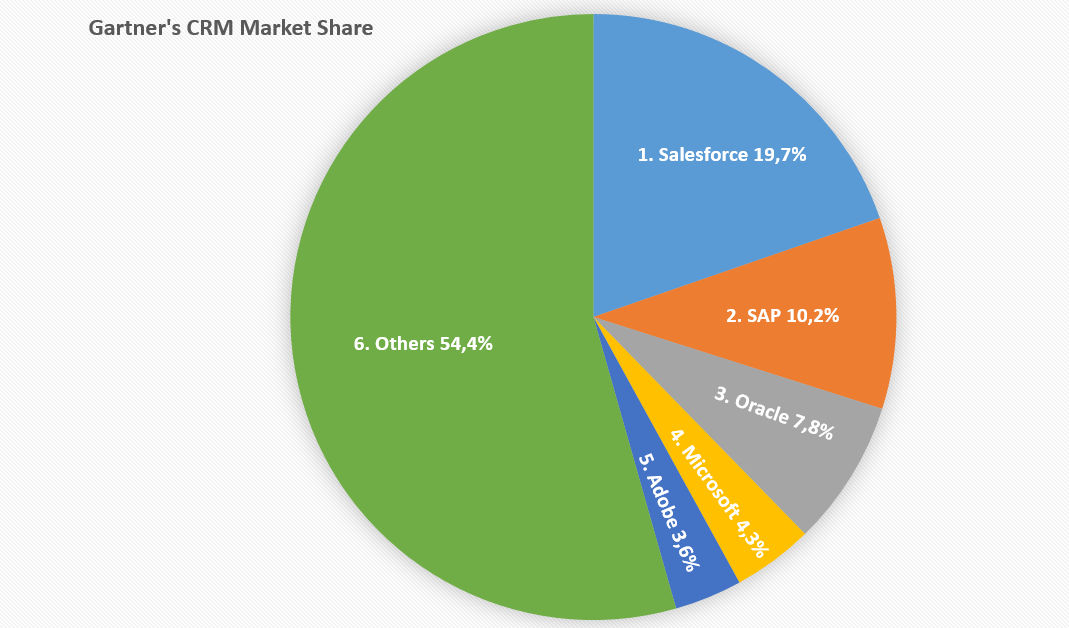

Gartner’s research for 2015

Compared to 2014 almost all the companies mentioned above have increased their market share. Salesforce by 1,5%, SAP 2,8%, Microsoft 0,3% and Adobe by 0,4%.

This ensures once again that the CRM world is in full growing power. All the growth comes from constant implementation of new features such as social medias, file sharing, help desk software, etc.

Oracle is the only company that lost their market share – it decreased by 1%, but is still

3,5% ahead of Microsoft.

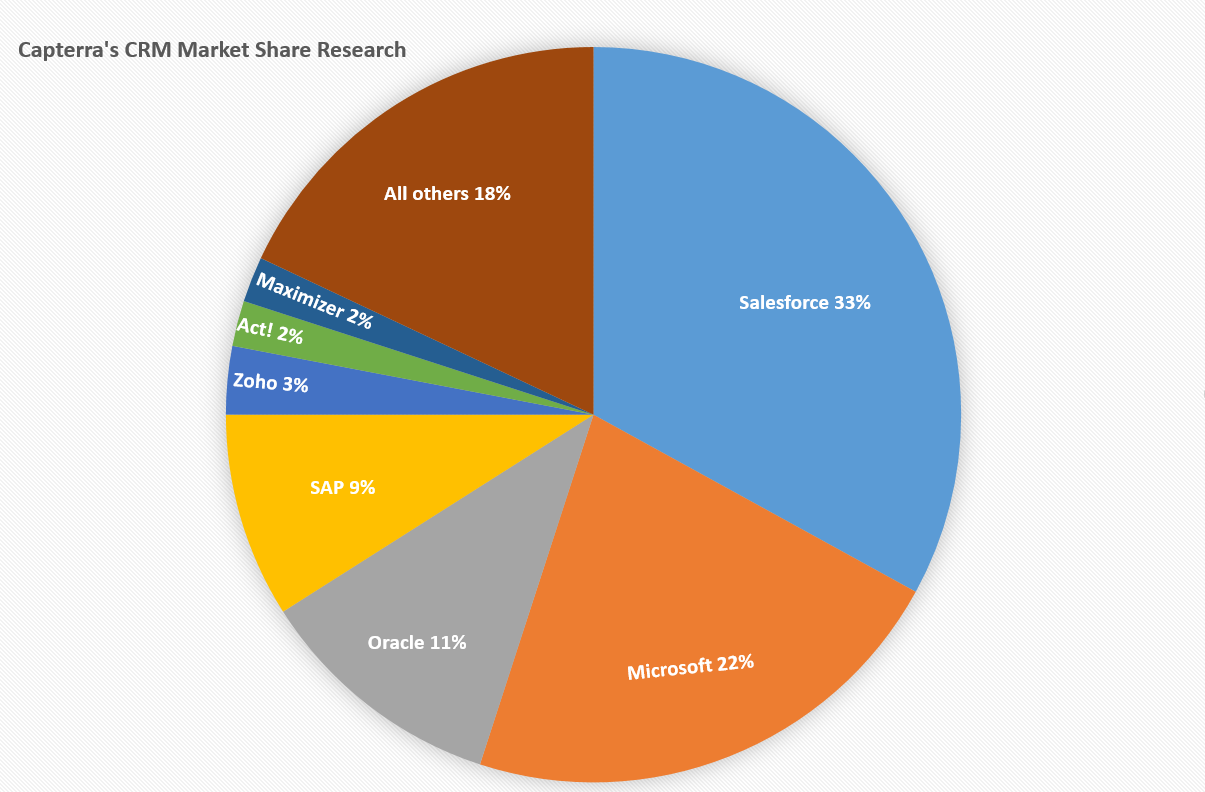

Capterra’s research for 2015

I could not find a market research for the year 2014. It doesn’t mean that Capterra didn’t make one, just that it might be very well hidden.

Conclusion

The difference in these two researches comes from audience size. Gartner’s research is based on worldwide results, whereas Capterra has only taken into consideration the votes from the United States.

Salesforce, Microsoft, Oracle and SAP are ruling the U.S. market with more than 70% market share, this does not leave much power to all the other, some still emerging, software providers.

The picture is not that dark on a worldwide basis. The shares seem to be a bit more evenly divided. The top four companies that rule the U.S. own only around 45% of the worldwide CRM earnings. Leaving 55% of decision power scattered between all the other players on the field.

The world of CRM software is growing and still developing. With a prediction of about 10% growth by 2017, our top 4 will definitely be challenged by growing system providers such as Hubspot, Zoho, Insightly, etc.